Gas and Mileage

Student groups can reimburse members for VSO-related travel via private automobiles, whether gas, electric, or hybrid. Reimbursement is only allowed for the driver of the vehicle. Passengers are not eligible to receive mileage or gas reimbursements unless they are the ones to pay for the gas.

Note: Gas reimbursement is determined based on whether the vehicle is a rental or personal.

Rental Vehicle: Reimbursement is based on gas refueling receipts.

Personal Vehicle: Reimbursement is based on miles driven. Please provide a screenshot of the route from Google Maps, clearly showing the departure and arrival locations.

Your VSO has two methods to reimburse drivers for gas expenses related to university activities:

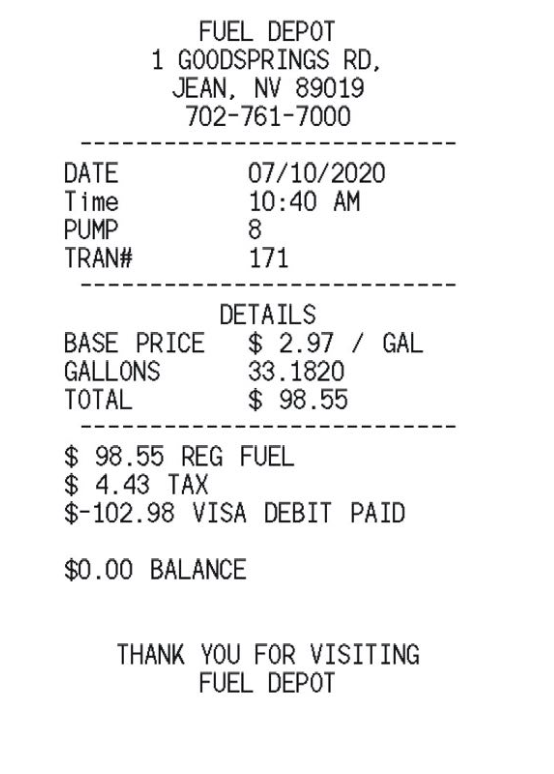

Receipt-Based Reimbursement for RENTALS:

Drivers can submit an itemized receipt from a gas station to be reimbursed for fuel purchases. Make sure the receipt clearly shows the gallons filled, the cost per gallon, the total amount, and the date of purchase. An example of an acceptable receipt is below.Note: For prepaid gas receipts, drivers must also provide a bank statement showing the posted charge to verify the final amount charged.

If you only want to reimburse part of the total, you will list the amount you want to reimburse and note "Partial Reimbursement" in the line description on GrantEd.

Mileage-Based Reimbursement for PERSONAL VEHICLES:

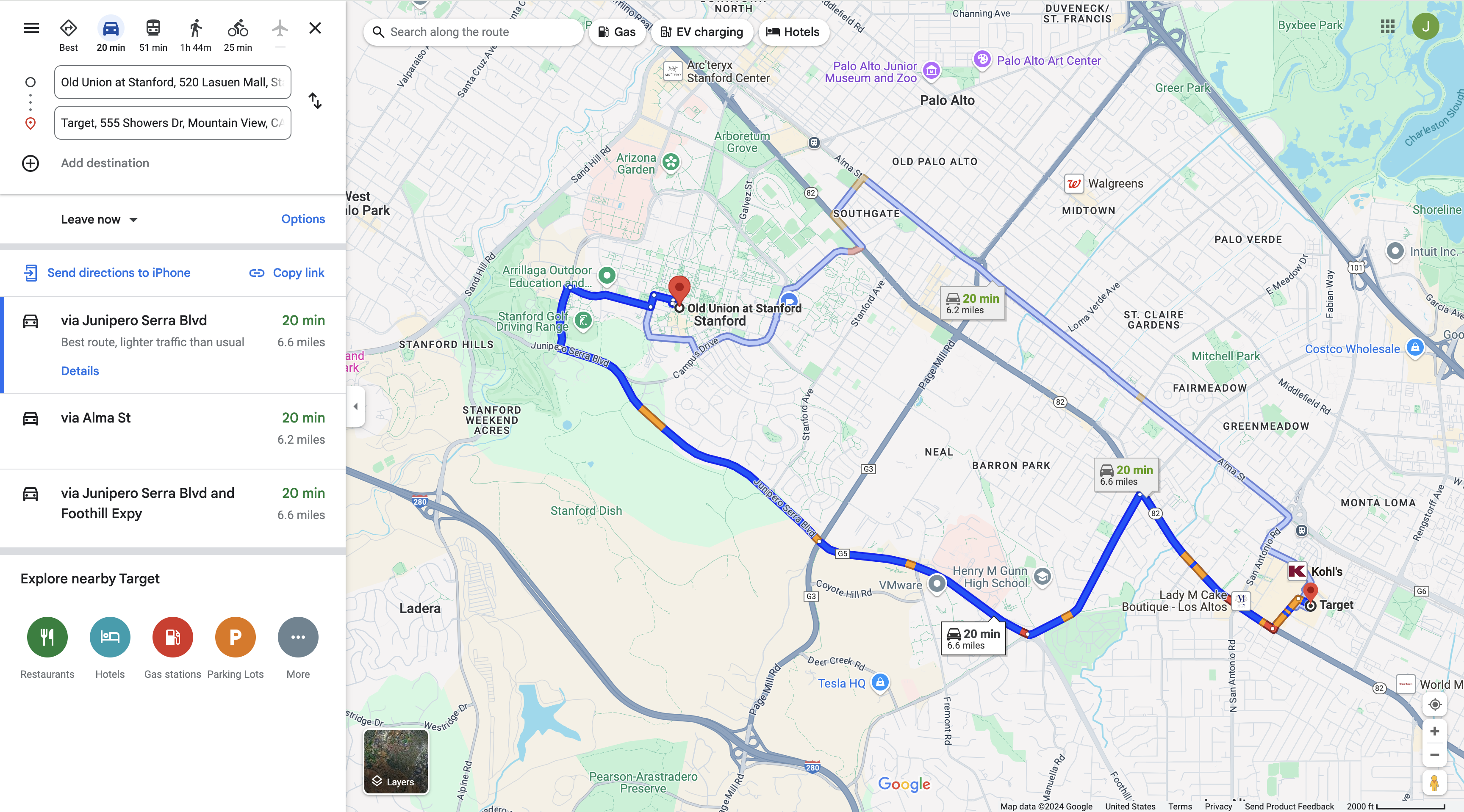

Drivers can also choose to be reimbursed based on mileage. To do this:Take a screenshot of the most direct route (most efficient option) taken using Google Maps, showing the starting point and destination, along with the total miles traveled.

Multiply the total miles traveled by the current IRS gas mileage reimbursement rate (listed below). This rate may change annually, so ensure you are using the correct rate for travel within the specific date range.

IRS Mileage Reimbursement Rates

For Travel Occurring: | Jan. 1- Dec. 31, 2025 | Jan 1 - Dec 31, 2026 |

Rate per Mile: | $0.7 | $0.725 |

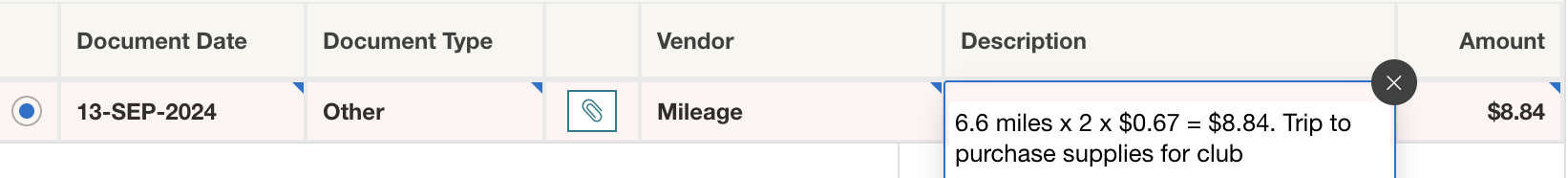

Submitting a Mileage-Based Reimbursement on GrantEd

The Google Maps screenshot should include all the information as shown below and be attached to the documentation section on GrantEd.

Since we traveled 6.6 miles on the above trip, we will include the calculation in the GrantEd Line Description for this specific reimbursement - 6.6 miles x $0.67 = $4.42. Let's say this was a round trip we would do - 6.6 miles x 2 roundtrip x $0.67 = $8.84. This is how it would look like on GrantEd: